Convenient Medicare Supplements: Medicare Supplement Plans Near Me

Convenient Medicare Supplements: Medicare Supplement Plans Near Me

Blog Article

Just How Medicare Supplement Can Enhance Your Insurance Policy Coverage Today

In today's facility landscape of insurance coverage alternatives, the function of Medicare supplements attracts attention as an important part in enhancing one's insurance coverage. As people navigate the intricacies of health care strategies and seek detailed defense, understanding the nuances of supplementary insurance coverage comes to be increasingly crucial. With an emphasis on bridging the gaps left by standard Medicare strategies, these additional choices supply a tailored technique to conference specific needs. By checking out the benefits, protection choices, and price factors to consider connected with Medicare supplements, individuals can make educated choices that not only reinforce their insurance coverage however likewise give a complacency for the future.

The Fundamentals of Medicare Supplements

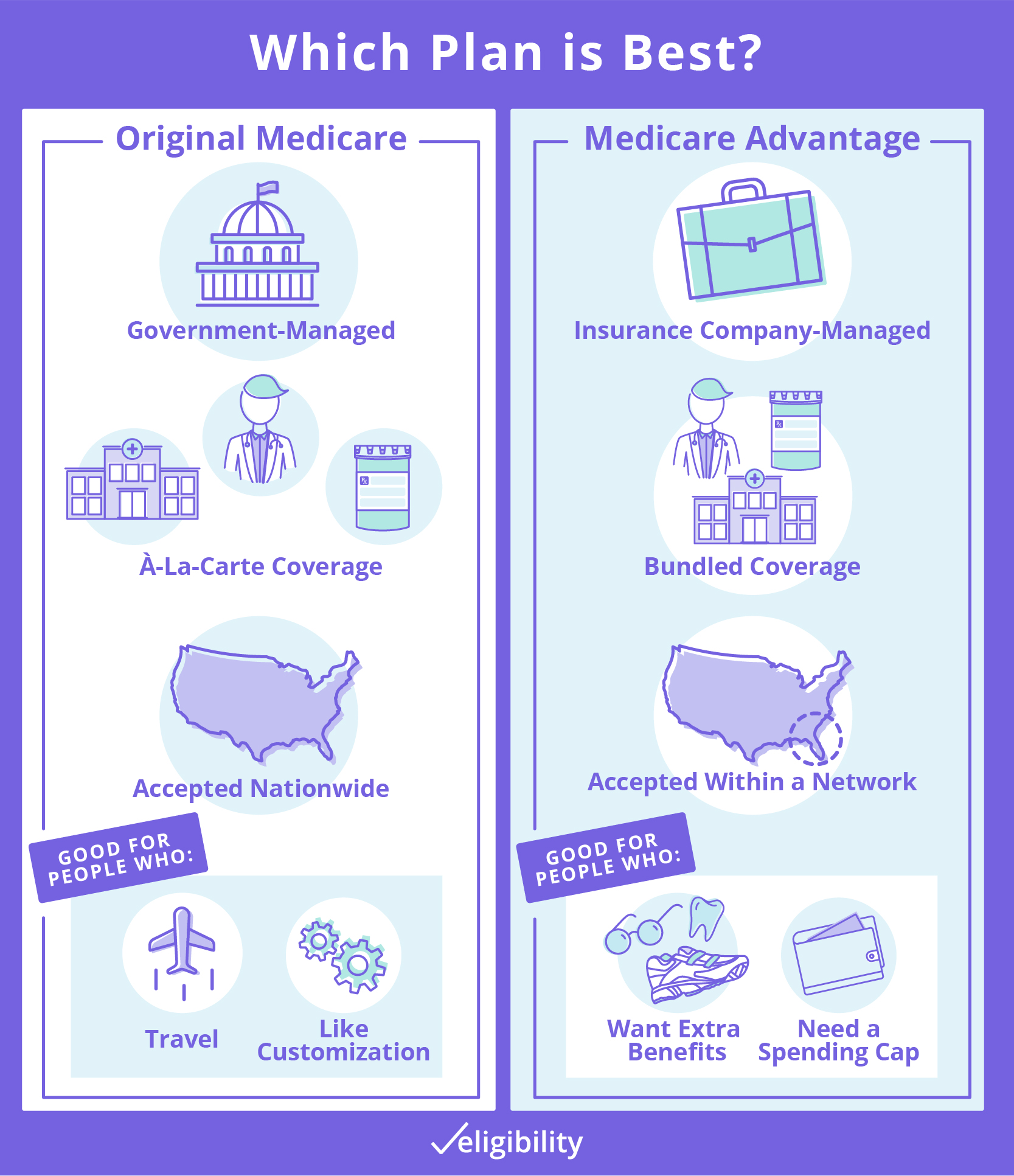

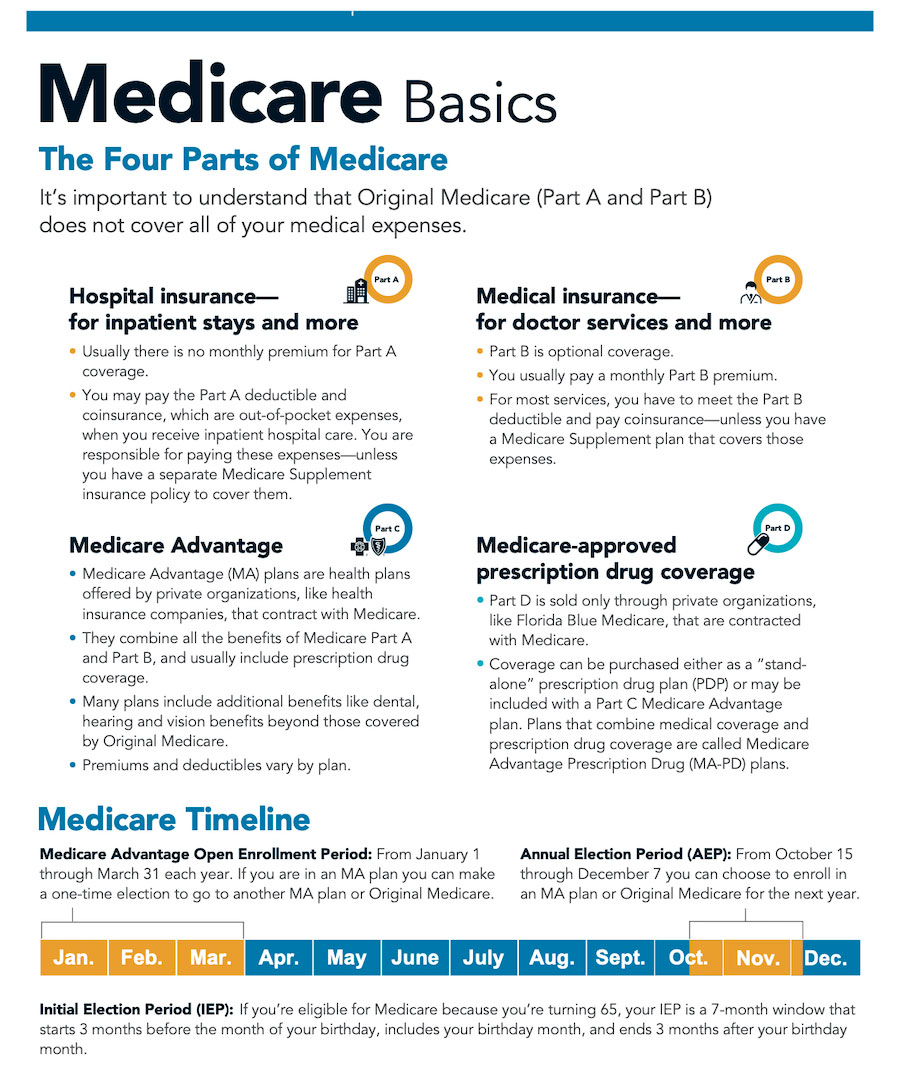

Medicare supplements, additionally called Medigap plans, supply additional insurance coverage to fill the gaps left by original Medicare. These auxiliary plans are provided by personal insurance provider and are made to cover expenses such as copayments, coinsurance, and deductibles that are not fully covered by Medicare Part A and Part B. It's necessary to keep in mind that Medigap strategies can not be used as standalone policies but work together with initial Medicare.

One secret facet of Medicare supplements is that they are standard throughout most states, providing the exact same fundamental benefits despite the insurance coverage service provider. There are ten various Medigap plans labeled A with N, each offering a different level of protection. Plan F is one of the most extensive options, covering nearly all out-of-pocket prices, while other plans may offer more minimal coverage at a reduced costs.

Comprehending the basics of Medicare supplements is important for individuals approaching Medicare qualification who desire to boost their insurance coverage and lower possible monetary burdens connected with health care costs.

Understanding Protection Options

Exploring the varied series of protection alternatives offered can give important understandings into supplementing health care expenditures efficiently. When considering Medicare Supplement prepares, it is crucial to comprehend the various coverage options to make sure comprehensive insurance defense. Medicare Supplement prepares, also referred to as Medigap plans, are standard throughout many states and identified with letters from A to N, each offering differing degrees of coverage. These plans cover copayments, coinsurance, and deductibles that Original Medicare does not completely spend for, providing beneficiaries with financial safety and security and satisfaction. In addition, some strategies may provide protection for services not consisted of in Original Medicare, such as emergency care during foreign travel. Comprehending the coverage alternatives within each plan kind is vital for people to choose a plan that lines up with their certain medical care demands and budget. By thoroughly examining the protection choices offered, beneficiaries can make educated decisions to boost their insurance policy coverage and efficiently handle health care expenses.

Advantages of Supplemental Program

Recognizing the considerable advantages of supplemental strategies can illuminate the worth they give individuals seeking enhanced medical care protection. One key advantage of additional strategies is the monetary safety and security they supply by assisting to cover out-of-pocket prices that original Medicare does not totally pay for, such as deductibles, copayments, and coinsurance. This can result in considerable savings for insurance holders, particularly those who call for frequent clinical services or treatments. In addition, extra plans supply a wider array of coverage alternatives, including accessibility to healthcare service providers that might decline Medicare project. This adaptability can be vital for individuals who have details health care demands or choose certain physicians or professionals. Another advantage of supplementary strategies is the ability to travel with tranquility of mind, as some strategies provide protection for emergency situation more medical services while abroad. In general, the advantages of supplementary plans add to an extra comprehensive and customized technique to medical care coverage, guaranteeing that individuals can obtain the care they need without facing overwhelming financial concerns.

Price Factors To Consider and Cost Savings

Offered the monetary security and more comprehensive insurance coverage choices offered by supplemental strategies, a vital facet to think about is the cost factors to consider and possible savings they supply. While Medicare Supplement prepares require a month-to-month premium in addition to the standard Medicare Part B costs, the benefits of reduced out-of-pocket expenses typically surpass the added expenditure. When reviewing the expense of supplementary plans, it is important to contrast costs, deductibles, copayments, and coinsurance across various plan kinds to identify one of the most affordable alternative based on specific medical care needs.

In addition, choosing a strategy that straightens with one's health and wellness and financial requirements can lead to considerable savings gradually. By picking a Medicare Supplement plan that covers a higher percent of healthcare costs, people can minimize unforeseen prices and budget a lot more effectively for healthcare. In addition, some supplemental plans use find here household discounts or rewards for healthy and balanced actions, providing additional chances for cost financial savings. Medicare Supplement plans near me. Ultimately, investing in a Medicare Supplement strategy can supply valuable financial security and comfort for recipients looking for comprehensive coverage.

Making the Right Option

Choosing the most suitable Medicare Supplement plan demands mindful factor to consider of private health care requirements and monetary circumstances. With a range of plans readily available, it is important to examine variables such as insurance coverage alternatives, premiums, out-of-pocket costs, company networks, and general value. Recognizing your existing health and wellness standing and any kind of expected medical needs can lead you in picking a plan that provides comprehensive insurance coverage for services you may call for. Furthermore, evaluating your budget restrictions and comparing premium prices amongst different strategies can assist ensure that you pick a plan that is cost effective in the long term.

Conclusion

Report this page